How Do I Avoid Capital Gains Tax When Selling A House In California . — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. Here are some ways to try to avoid capital gains taxes when selling a house. Your gain from the sale was less than $250,000. — you have to pay capital gains tax on real estate profits. the best way to avoid capital gains tax on the sale of your california residential real estate is to take full advantage of the. you do not have to report the sale of your home if all of the following apply: We’re retired and living in california. This means that you can exclude up to a. — you earned more than the allowable exclusion: may 1, 2022 5 am pt. when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules. If you sell your house and earn more than. We are planning on selling our home, which is paid for, and moving to tennessee in a.

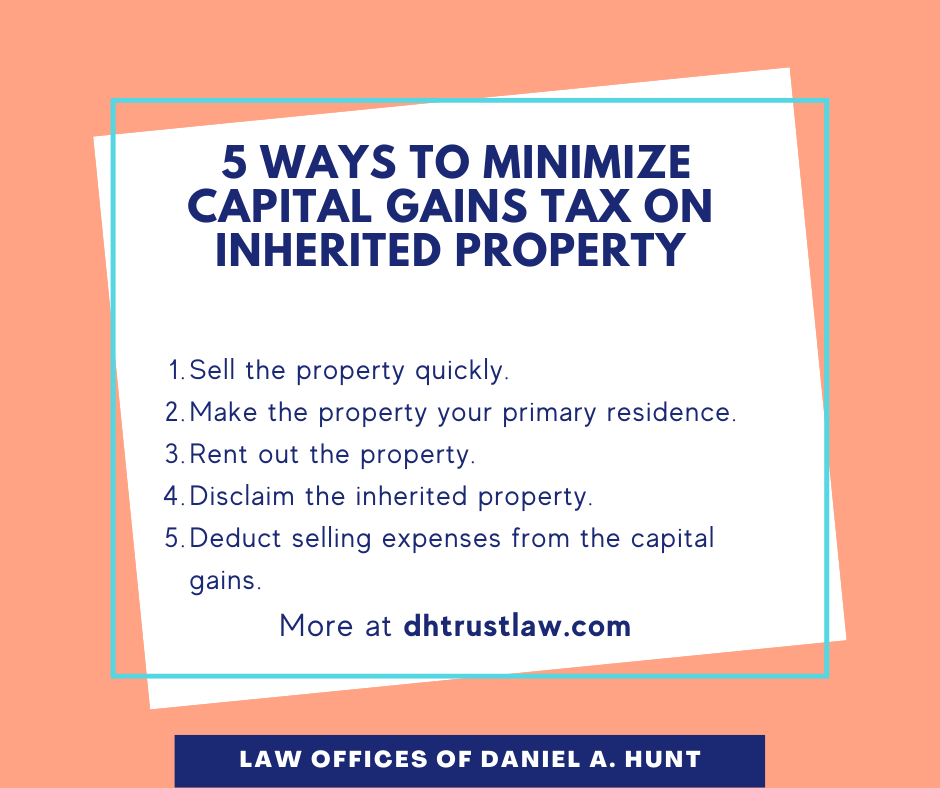

from www.dhtrustlaw.com

you do not have to report the sale of your home if all of the following apply: when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules. If you sell your house and earn more than. We are planning on selling our home, which is paid for, and moving to tennessee in a. — you have to pay capital gains tax on real estate profits. may 1, 2022 5 am pt. Here are some ways to try to avoid capital gains taxes when selling a house. We’re retired and living in california. — you earned more than the allowable exclusion: — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or.

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt

How Do I Avoid Capital Gains Tax When Selling A House In California This means that you can exclude up to a. Here are some ways to try to avoid capital gains taxes when selling a house. Your gain from the sale was less than $250,000. — you have to pay capital gains tax on real estate profits. This means that you can exclude up to a. the best way to avoid capital gains tax on the sale of your california residential real estate is to take full advantage of the. We are planning on selling our home, which is paid for, and moving to tennessee in a. — you earned more than the allowable exclusion: — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. you do not have to report the sale of your home if all of the following apply: If you sell your house and earn more than. We’re retired and living in california. may 1, 2022 5 am pt. when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules.

From www.mechanic-insurance.com

Capital Gains Tax When Selling Your Home Mechanic & Associates, Inc. How Do I Avoid Capital Gains Tax When Selling A House In California Your gain from the sale was less than $250,000. — you earned more than the allowable exclusion: Here are some ways to try to avoid capital gains taxes when selling a house. We’re retired and living in california. the best way to avoid capital gains tax on the sale of your california residential real estate is to take. How Do I Avoid Capital Gains Tax When Selling A House In California.

From insurancenoon.com

How Do I Avoid Capital Gains Tax When Selling A House? Insurance Noon How Do I Avoid Capital Gains Tax When Selling A House In California — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. you do not have to report the sale of your home if all of the following apply: may 1, 2022 5 am pt. If you sell your house and earn more than. We are planning. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.mechanic-insurance.com

Capital Gains Tax When Selling Your Home Mechanic & Associates, Inc. How Do I Avoid Capital Gains Tax When Selling A House In California — you earned more than the allowable exclusion: If you sell your house and earn more than. Here are some ways to try to avoid capital gains taxes when selling a house. This means that you can exclude up to a. — the california capital gains tax is due to both federal (the irs) and state tax agencies. How Do I Avoid Capital Gains Tax When Selling A House In California.

From andersonadvisors.com

Guide How to Avoid Capital Gains Tax on Real Estate How Do I Avoid Capital Gains Tax When Selling A House In California If you sell your house and earn more than. — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. We are planning on selling our home, which is paid for, and moving to tennessee in a. We’re retired and living in california. Here are some ways to. How Do I Avoid Capital Gains Tax When Selling A House In California.

From andersonadvisors.com

Guide How to Avoid Capital Gains Tax on Real Estate How Do I Avoid Capital Gains Tax When Selling A House In California you do not have to report the sale of your home if all of the following apply: when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules. If you sell your house and earn more than. — you earned more than the allowable exclusion: the best way. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.sellingmybusiness.co.uk

Capital Gains Tax when selling a business Selling My Business How Do I Avoid Capital Gains Tax When Selling A House In California — you earned more than the allowable exclusion: — you have to pay capital gains tax on real estate profits. Here are some ways to try to avoid capital gains taxes when selling a house. This means that you can exclude up to a. If you sell your house and earn more than. may 1, 2022 5. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.thehivelaw.com

How Much Time After Selling A House Do You Have To Buy A House To Avoid How Do I Avoid Capital Gains Tax When Selling A House In California — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. If you sell your house and earn more than. you do not have to report the sale of your home if all of the following apply: — you earned more than the allowable exclusion: We’re. How Do I Avoid Capital Gains Tax When Selling A House In California.

From hackyourwealth.com

How to avoid capital gains taxes when selling your house How Do I Avoid Capital Gains Tax When Selling A House In California Your gain from the sale was less than $250,000. We’re retired and living in california. you do not have to report the sale of your home if all of the following apply: — you earned more than the allowable exclusion: the best way to avoid capital gains tax on the sale of your california residential real estate. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.carringtonaccountancy.com

Selling a second home? Beware of the Capital Gains Tax change How Do I Avoid Capital Gains Tax When Selling A House In California the best way to avoid capital gains tax on the sale of your california residential real estate is to take full advantage of the. — you earned more than the allowable exclusion: you do not have to report the sale of your home if all of the following apply: We are planning on selling our home, which. How Do I Avoid Capital Gains Tax When Selling A House In California.

From investguiding.com

Capital Gains Tax on Real Estate And How to Avoid It (2024) How Do I Avoid Capital Gains Tax When Selling A House In California when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules. This means that you can exclude up to a. — you earned more than the allowable exclusion: If you sell your house and earn more than. — the california capital gains tax is due to both federal (the. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.bhg.com.au

How to Avoid Capital Gains Tax When Selling a House (How Long How Do I Avoid Capital Gains Tax When Selling A House In California This means that you can exclude up to a. may 1, 2022 5 am pt. Your gain from the sale was less than $250,000. you do not have to report the sale of your home if all of the following apply: when selling your home, the rules for california’s capital gains tax align with the federal government’s. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.propertytaxsolutions.com.au

Capital Gains Tax When You Sell Your Property Property Tax Specialists How Do I Avoid Capital Gains Tax When Selling A House In California may 1, 2022 5 am pt. — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. Here are some ways to try to avoid capital gains taxes when selling a house. — you have to pay capital gains tax on real estate profits. If you. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.livemint.com

How to disclose capital gains in your tax return How Do I Avoid Capital Gains Tax When Selling A House In California — you have to pay capital gains tax on real estate profits. We are planning on selling our home, which is paid for, and moving to tennessee in a. — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. you do not have to report. How Do I Avoid Capital Gains Tax When Selling A House In California.

From giovtxxms.blob.core.windows.net

Does California Charge Sales Tax On Real Estate Sales at Ouida Re blog How Do I Avoid Capital Gains Tax When Selling A House In California may 1, 2022 5 am pt. This means that you can exclude up to a. Here are some ways to try to avoid capital gains taxes when selling a house. — you earned more than the allowable exclusion: when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules.. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.dhtrustlaw.com

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt How Do I Avoid Capital Gains Tax When Selling A House In California — the california capital gains tax is due to both federal (the irs) and state tax agencies (the franchise tax board or. the best way to avoid capital gains tax on the sale of your california residential real estate is to take full advantage of the. We are planning on selling our home, which is paid for, and. How Do I Avoid Capital Gains Tax When Selling A House In California.

From www.transformproperty.co.in

Capitalgainstaxinfographic Transform Property Consulting How Do I Avoid Capital Gains Tax When Selling A House In California you do not have to report the sale of your home if all of the following apply: We are planning on selling our home, which is paid for, and moving to tennessee in a. when selling your home, the rules for california’s capital gains tax align with the federal government’s irs tax rules. — you have to. How Do I Avoid Capital Gains Tax When Selling A House In California.

From dmhomebuyers.net

Do Senior Citizens pay Capital Gains Tax When Selling Their Homes in IA How Do I Avoid Capital Gains Tax When Selling A House In California Here are some ways to try to avoid capital gains taxes when selling a house. We’re retired and living in california. the best way to avoid capital gains tax on the sale of your california residential real estate is to take full advantage of the. — you have to pay capital gains tax on real estate profits. Your. How Do I Avoid Capital Gains Tax When Selling A House In California.

From executiveseats.blogspot.com

do you pay capital gains on primary residence How Do I Avoid Capital Gains Tax When Selling A House In California you do not have to report the sale of your home if all of the following apply: the best way to avoid capital gains tax on the sale of your california residential real estate is to take full advantage of the. If you sell your house and earn more than. Your gain from the sale was less than. How Do I Avoid Capital Gains Tax When Selling A House In California.